All Categories

Featured

Table of Contents

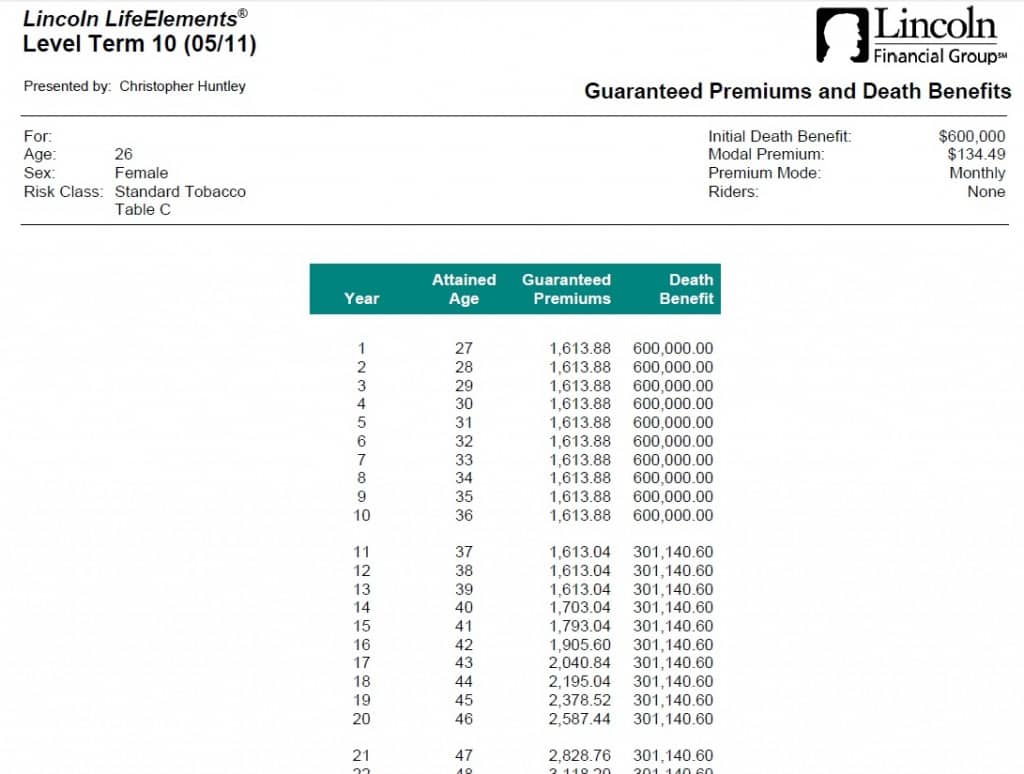

A degree term life insurance policy plan can give you satisfaction that individuals that rely on you will have a death benefit during the years that you are planning to sustain them. It's a way to help take treatment of them in the future, today. A level term life insurance policy (in some cases called level costs term life insurance coverage) policy gives insurance coverage for an established variety of years (e.g., 10 or two decades) while keeping the premium settlements the exact same throughout of the policy.

With level term insurance, the price of the insurance coverage will remain the exact same (or possibly lower if rewards are paid) over the term of your plan, generally 10 or 20 years. Unlike irreversible life insurance policy, which never ever runs out as long as you pay premiums, a level term life insurance policy policy will certainly end at some point in the future, normally at the end of the period of your level term.

Discover What Term Life Insurance For Couples Is

As a result of this, lots of people utilize irreversible insurance policy as a stable monetary planning tool that can offer lots of needs. You may have the ability to transform some, or all, of your term insurance coverage during a collection period, usually the very first one decade of your plan, without requiring to re-qualify for coverage even if your wellness has actually transformed.

As it does, you might desire to include to your insurance coverage in the future - Term life insurance for spouse. As this occurs, you might desire to at some point reduce your death advantage or take into consideration transforming your term insurance policy to a long-term policy.

As long as you pay your costs, you can rest very easy recognizing that your liked ones will obtain a fatality benefit if you die during the term. Lots of term plans allow you the ability to convert to irreversible insurance coverage without having to take one more wellness test. This can allow you to make use of the extra advantages of a long-term plan.

Level term life insurance policy is among the easiest paths into life insurance policy, we'll review the advantages and drawbacks to make sure that you can choose a plan to fit your demands. Degree term life insurance is the most typical and basic type of term life. When you're seeking momentary life insurance policy plans, degree term life insurance policy is one course that you can go.

The application procedure for degree term life insurance coverage is normally extremely uncomplicated. You'll complete an application that consists of general individual info such as your name, age, and so on as well as a more in-depth questionnaire concerning your case history. Relying on the plan you have an interest in, you might need to join a medical checkup procedure.

The brief answer is no. A degree term life insurance plan doesn't construct cash money worth. If you're aiming to have a policy that you're able to take out or obtain from, you may explore permanent life insurance policy. Entire life insurance policy policies, for instance, allow you have the comfort of survivor benefit and can accumulate cash money worth gradually, indicating you'll have more control over your benefits while you're alive.

What is Guaranteed Level Term Life Insurance? Pros and Cons

Riders are optional arrangements added to your policy that can give you additional benefits and protections. Anything can occur over the course of your life insurance term, and you desire to be prepared for anything.

There are instances where these advantages are built into your plan, however they can additionally be available as a different addition that requires added repayment.

Latest Posts

Final Expense Quote

Final Expenses Insurance For Seniors

Burial Insurance For My Parents